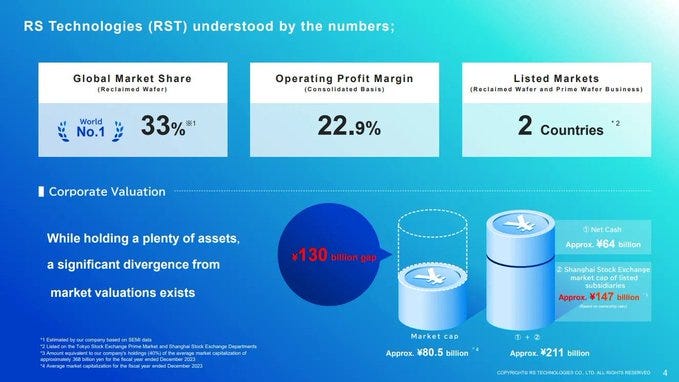

RS Technologies: A Deep-Value GARP Semiconductor Supply chain play Hiding in Plain Sight - 30%y/y growth

Looking for your next undiscovered Asian Semiconductor supply chain play?

Look no further. The name is well known, but not well understood.

Valuation:

Grew revenues at 30% y/y LTM

9.5 P/E

Trades for less than ownership of listed subsidiary

Business Overview

RS Technologies is a Japanese semiconductor supply chain company operating a group of manufacturing and distribution businesses focused on mission critical inputs to semiconductor fabrication.

The company operates in three main areas:

The core business is reclaimed wafers. These are silicon wafers that have been previously used in production, then cleaned, polished, and restored for reuse. They are used for equipment calibration, process qualification, test runs, particle monitoring, and general line setup. These wafers are consumed continuously as part of normal fab operations. They are not optional inputs. While the product is commoditized, reliability and consistency matter because defects directly impact yield and cost.

This is not a sales gimmick for improving yields, every major fab uses reclaimed wafers on a recurring basis. (TSMC, SMIC, etc.)

The second business is prime silicon wafer manufacturing. These wafers are the physical substrate used to produce chips and are sold into markets such as power semiconductors, automotive, industrial, and energy related applications. This business is lower margin, more competitive, and more cyclical, but benefits from customer qualification processes and switching costs. Once a wafer supplier is qualified, customers are reluctant to switch due to yield and process risk.

Also, you get it for free. More on that later.

The third area is a collection of smaller semiconductor related manufacturing and distribution businesses. These include components, materials, inspection related products, and other niche parts of the semiconductor supply chain. Individually these businesses are small. Collectively they form a broader product offering that can be sold into the same customer base.

Business Model and Strategy

The reclaimed wafer business functions as the anchor of the company. It creates recurring, operationally embedded relationships with customers. RS uses its direct sales organization and existing customer access to cross sell additional products and to integrate acquired businesses into the same distribution channel. Additionally, some analysts infer some degree of technological bleed through from reclaimed wafer to prime wafer manufacturing. (Analyst report linked in the comments).

The strategy is to acquire niche, mission critical suppliers and increase their value by expanding distribution through RS’s existing sales network. The goal is not technological integration but commercial integration. Over time, the company expands its share of customer spending by offering a broader set of inputs into the same manufacturing process. This is supported by leadership under Nagayoshi Ho who specializes in M&A. He is the company’s Chairman and CEO and has served in that role since the company’s founding in 2010. He also holds a significant ownership stake in the business.

As I’ve learned more about RS Technologies, one thing has become increasingly clear: as long as the business model remains intact, this is an enduring franchise.

Even if individual business lines stumble or certain technologies become obsolete, the mothership of RS supported by reclaimed wafer will thrive.

RS Technologies is not a “single product” company. It is a conglomerate of mission-critical semiconductor supply chain businesses, built around:

A dominant reclaimed wafer platform

A growing prime wafer manufacturing operation

A collection of semiconductor-related manufacturing and distribution businesses

There is a flywheel affect to the M&A process:

The reclaimed wafer business creates long-term customer relationships →

The direct sales network monetizes those relationships →

M&A expands the product surface area →

Which further increases the power of the sales network →

Which funds more expansion.

The Core Insight: The Sales & Distribution Flywheel

RS’s main business—reclaimed wafers—is a recurring, operationally critical product used throughout the semiconductor manufacturing process:

Equipment calibration

Process qualification

Test runs

Particle monitoring

And general production setup

These wafers are not optional. They are embedded in the daily workflow of fabs.

Because of this:

RS has deep, recurring relationships with customers

Those relationships are operational, not transactional

Switching suppliers carries process risk

This creates a powerful distribution asset.

Management then uses this distribution channel to:

Acquire niche, mission-critical suppliers

Plug them into the same customer network

Cross-sell new products into an already captive base

Over time, the whole becomes more valuable than the sum of the parts.

Why The Business Is Likely More Durable Than It Looks

1) Reclaimed wafers are process infrastructure

They are not a “feature.” They are part of how fabs operate.

Could this change in 10–20 years? Possibly.

But it would require a fundamental redesign of how chips are manufactured.

That’s not a small innovation cycle.

2) Prime wafers are the physical foundation of semiconductors

No wafer = no chip.

Even as architectures evolve, the need for ultra-pure substrates remains, even more so.

3) The rest of the business is diversified across:

Products

End markets

Geographies

Technologies

The Strategic Moat: Distribution, Not Technology

RS’s real moat is not IP.

It is:

Embedded relationships

Process trust

Sales coverage

And operational intimacy with customers

This is extremely hard to replicate.

A new competitor doesn’t just need a better product.

They need:

Years of qualification

Process trust

And risk acceptance from fabs that lose millions per hour if something goes wrong

Why It’s Misunderstood

RS is:

Not a pure-play AI winner

Not a hype semiconductor name

Not a story stock

Not listed in the US

US markets glamorize:

ASML

KLA

AMAT

But the global supply chain has dozens of equally critical companies that simply don’t get narrative attention.

The Risks

Capital allocation and M&A risk.

The company relies heavily on acquisitions to drive growth. While management has experience in this area, there is no guarantee future acquisitions will be executed at attractive prices or generate acceptable returns on capital. A period of aggressive or poorly priced acquisitions could permanently impair shareholder value.

Technological obsolescence.

Parts of the company’s business portfolio are exposed to changes in semiconductor manufacturing processes. While reclaimed wafers are currently embedded in production workflows, it is possible that future process changes reduce or eliminate their relevance. Other smaller business lines may also become obsolete over time.

Commoditization and pricing pressure.

Several of the company’s products, including reclaimed and prime wafers, are fundamentally commodity-like. While switching costs and qualification requirements provide some protection, prolonged industry overcapacity or aggressive competition could pressure margins.

Cyclicality of semiconductor capital spending.

End demand is ultimately tied to semiconductor manufacturing investment. A prolonged downturn in fab utilization or capital spending could reduce volumes across multiple business lines simultaneously.

The Big Picture

RS Technologies is:

A collection of mission-critical supply chain businesses

Bound together by a powerful sales and distribution engine

Using M&A to expand its economic surface area

In industries that will be needed for decades

Why I Like It

It sits under the entire semiconductor industry

It benefits from global chip proliferation, not just cutting-edge nodes

It has a distribution moat, not just a product moat

It is structurally positioned to keep adding businesses into its flywheel

If management executes even moderately well, the long-term outcome should be very good.

True ! Wait and watch here. I sold all of zengame.

I like it and I know you are super bullish . For some weird reason it hasn't run up with other semi caps. My brain says we are missing something that the market recognizes