Japanese Semi Stocks Tank, My Top Pick: 10 P/E, 6.7 EV/EBIT, 8.5% ROE

MC: $554m

LTM P/E: 10.14

EV/EBIT: 6.7

The past week of trading in Japan has crushed stocks for reasons I do not fully understand. For long-term investors picking businesses that return capital to shareholders, this presents a great buying opportunity. I go through why I like it, and more importantly why I don’t like it below:

To give you an idea of my strategy in Japan I’m looking for quality businesses that return capital to shareholders. Because of Japan’s aging population, I also look for businesses tied to global growth instead of Japan's growth.

RS Technologies (3445.T) is a Japanese semiconductor company that trades at a discount to its NAV, and intrinsic value. Anything touching the semi-supply chain in the US has skyrocketed over the PTM, but the equally important international companies haven’t. I’m looking for at least a 26% IRR from RS Technologies for it to become part of my concentrated portfolio.

Why it’s my top pick

As I describe below, the companies in RS Technologies are critical to the semiconductor supply chain. Some of which, face little competition and a growing overall demand. For the next 50 years, we will need some form of these companies to supply our demand for chips.

It’s significantly discounted to fair value, so even if the business underperforms the value gap can make up for it.

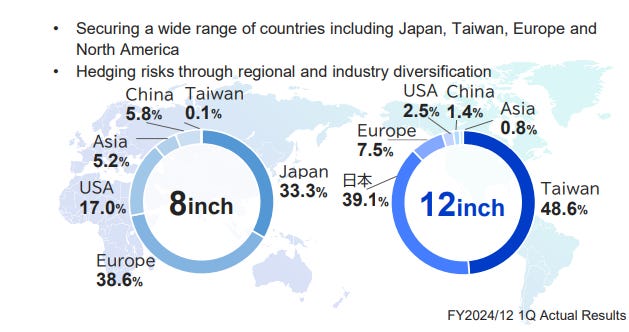

There is a diversification of countries and customers providing a steady base:

Why it’s bad

RS Technologies is guaranteed to have some businesses become irrelevant over the coming years due to advances in technology. No way to know what’s coming unless you are an Engineer studying the industry full time which I am certainly not.

For Example, I have no idea whether reclaimed wafers will be relevant to wafer production 10 years from now. Going to keep my nose to the grindstone and find out.

The M&A from the leadership could be destructive and result in below-average returns.

Quick description of operations

From a broad overview, RS Technologies is a bunch of critical semiconductor businesses under one umbrella. The management likes to buy other small companies that dominate essential portions of the supply chain. When a new business is purchased they bring them under the wing of their direct sales force, generating synergies.

Despite this, I do believe that generally M&A is destructive and don’t believe in Synergy

Here is the full list of businesses under the RS Technologies umbrella:

Why RS Technologies is undervalued

Today, the market cap is around 81b¥

Luckily the M&A is detailed pretty heavily by IR. This presentation describes and shows prospects for all the subsidiaries. From going through the full list they are all small, vital parts of the supply chain. The thought is that by incorporating them into the direct sales force, acquisitions can benefit from larger distribution channels.

Reclaimed Wafer Market

Reclaimed wafers, or “dummy wafers” are reusable wafers used to test the production lines of new chips for semi-manufacturers to not waste precious high-grade silicon. This is the largest segment of RS Technologies’ business. Overall the 12inch and 8inch reclaimed wafer markets are vital parts of the supply chain and may face less cyclicality. RS Technology is the leader in this market with a 33% share.

Based on the expansion of 12” wafer production, reclaimed wafer demand is expected to grow alongside it:

Capital Allocation

The main thesis behind the company is that the CEO who has extensive experience in M&A will be able to leverage the sales force of RS Technologies to sell other mission-critical Semi technologies. Over time we will see the true effectiveness of this strategy as they are long-term investments and in the short term, they can create discounts to NAV like Gritek.

Generally, I don’t like the companies I invest in to do M&A and don’t believe in business synergy most of the time. However, because of the discount to NAV, I don’t mind RS Technologies’ strategy as past investments give confidence to future returns. Even if ROIC from M&A is a lower number like 8%, because the NAV is greater than the market cap, the Shareholder return is amplified.

Reason for the discount

Some suggest that the reason for the discount is the nature of the company’s Prime wafer manufacturing, which is based in China. As an investor in Chinese securities, this does not bother me very much. The quality of the China-listed subsidiary GRINM Semiconductor Materials Co Ltd (SHA:688432) is more questionable than the reclaimed wafer operations, but the company has a decent track record of profitability.

Found this Idea from T.O. on X